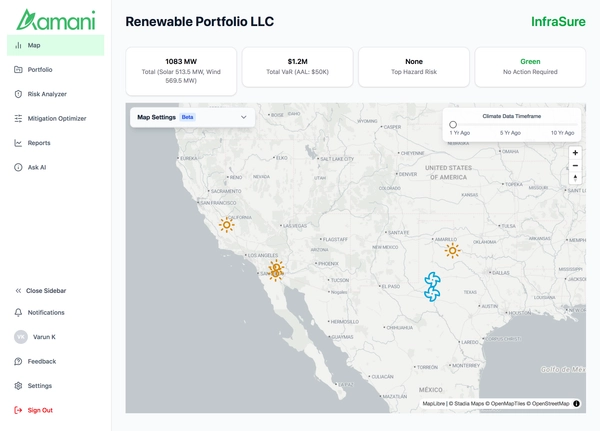

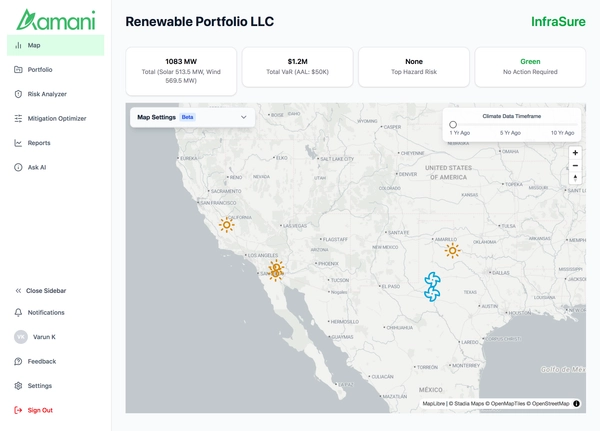

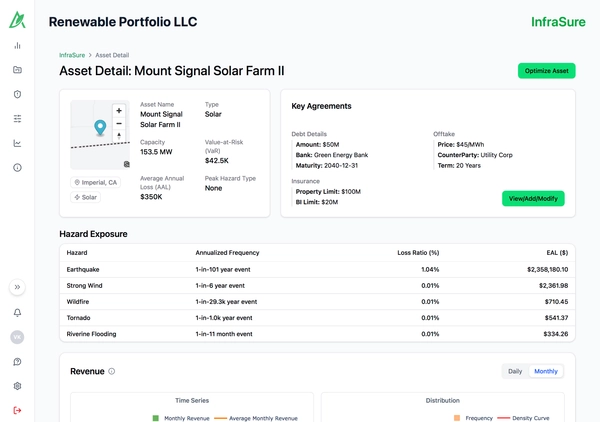

Objective risk quantification

Data-driven, asset-specific risk quantification in absolute probability and dollar terms is key to shared understanding between Insured (Risk Owner) and (Re)Insurer (Risk Taker)

Building the next generation of climate risk intelligence Transparency | Risk Differentiation | Innovation

$10T

Additional insurance capital needed to support $19T of clean energy investments now thru 2030

30%

Surging inflation and rising severe weather events climb from 160 to 190 in the past decade

398

Natural disasters caused $380 billion in losses in 2023 revealing a 69% global protection gap

60%

In 2024, only 40% of projected economic losses were insured, as the world breached 1.5°C of warming

Data-driven, asset-specific risk quantification in absolute probability and dollar terms is key to shared understanding between Insured (Risk Owner) and (Re)Insurer (Risk Taker)

Optimize all mitigation options, namely, Risk Transfers, Resilience Measures and Adaptation Procedures; and continuously monitor risk to maximize risk-adjusted returns

Need decision models that combine historical loss data with probabilistic risk distributions linked to causal factors and allow for different transaction structures

Helping quantify, mitigate and transfer weather-driven revenue volatility and physical damage risks

01

02

03

04

To quantify localized, asset-specific risk distributions capturing non-linear relationships between climate, energy markets and asset operations, alongside monitoring of impact of severe weather with mitigation recommendations

To optimize financial risk transfers (insurance, warranty, commercial contracts, derivatives and other), adaptation procedures and resilience measures in concert to maximize risk-adjusted returns

To structure and underwrite non-damage parametric insurance solutions to meet risk mitigation needs, where traditional insurance solutions are inadequate or unavailable

Building the next generation of climate risk intelligence. Get in touch to see how Aamani can support your infrastructure strategy